- Date: Aug 25, 2022

- Category:

Financial markets around the world saw the peak of Biotech indices in 2021. The people who saw this as an investment opportunity soon discovered it was not the case. The volatile nature of the stock market hit this sector severely. Biotech Radar founder Bertrand Delsuc commented, “It’s more of a total eclipse for Biotech, at least on the public markets.” In this article, we’ll do thorough Biotech industry analysis and find how financial markets impact Biotech companies.

Biotech Graph Rises Immediately Post-Pandemic

Biotech industry analysis reveals that the Biotech industry was one of the few industries that saw rapid growth during and immediately after the pandemic. While no IT, real estate, or consumer industry could tackle the pandemic, Biotech came to the rescue. All eyes were on these companies while they tried to come up with a cure.

The media constantly reported on any developments in the field, and even the government was forced to pay attention. This search for treatment and preventive solutions to the COVID-19 virus made pharmaceutical companies look like a good investment. This is how they recovered from the initial hit of the pandemic and even reached record peaks.

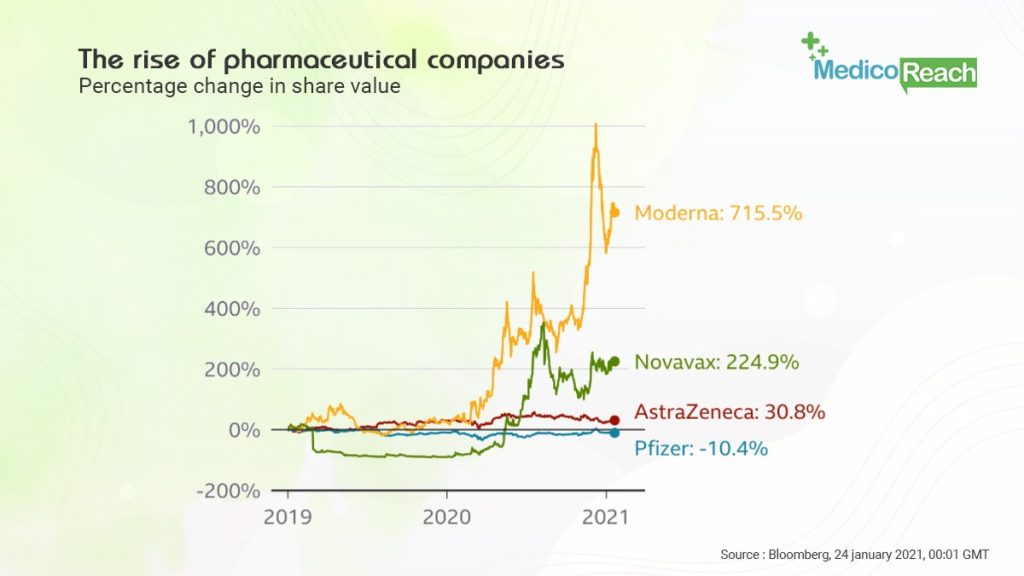

If you do Biotech industry analysis, you’ll realize that Moderna, Novavax, and AstraZeneca were among the pharmaceuticals that recorded significant rises. While many would’ve believed Pfizer to see unprecedented growth after the successful release of the vaccine. This was attributed to the growing number of competitors and the high cost of vaccine production.

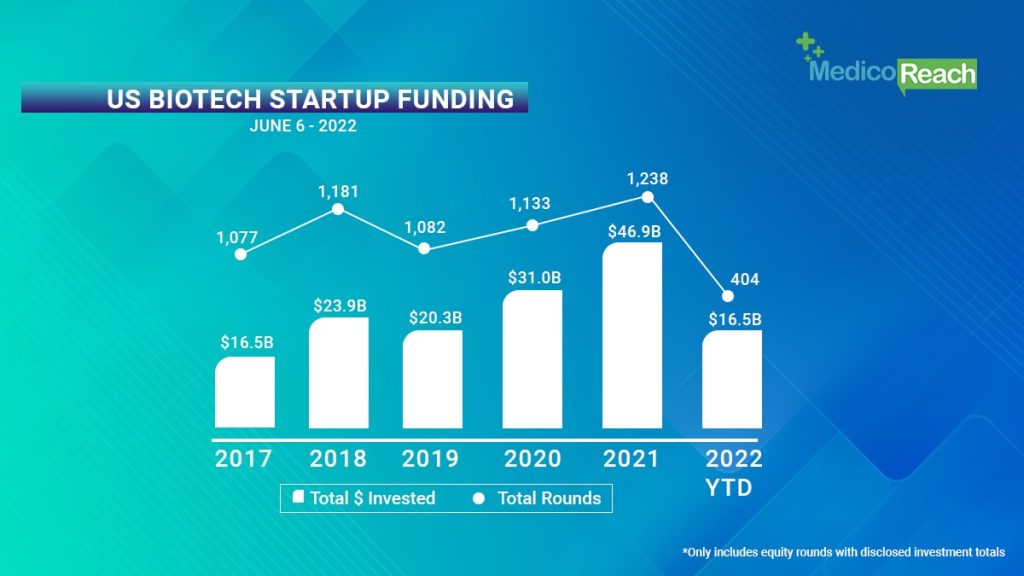

The increase in foreign investors was another reason for this hike. During this time, Biotech groups raised a record $32.7B in initial public offerings (IPOs). Evotec and Oxford Nanopore Technologies were among the Biotech companies that launched big initial public offerings (IPOs). This supply soon slowed down during the first quarter of 2022.

Biotech Startup Funding Slows Down Again in 2022

The record-breaking year for Biotech funding opened up to a much cooler market in 2022. In fact, compared to the past three years of Biotech trends analysis, new stock offerings in the First Quarter of 2022 were the lowest. For Biotech companies in their fledgling stages and their investors, the year has become a waiting game where patience is the key strategy to win.

The middle of 2022 looked no different as the number of Biotech startups that went public, and the amount of money raised by them on an average only plunged further. Where June 2021 saw nearly 45 Biotech startups going public, June 2022 stared at an almost stagnant number of 14. Not only that but also, out of these 14 startups, 10 of them even traded below their initial offering amount. If that wasn’t terrifying enough, even last year’s Initial Public Offerings (IPOs) witnessed a similar slump in 2022. Almost 80% of startups that went public in 2021 traded below their initial offering price in 2022. Even among the top 10 Biotech startups that went public last year, all, except for Verve Therapeutics, lost at least 40% of their initial offering value.

As we see, the downward spiraling, which started in the middle of 2021, continues to play out even in the second Quarter of 2022. There were a bunch of reasons that caused this downfall.

- Investors started to look for safer assets.

- Central banks had to increase interest rates due to inflation.

- The shares began to be seen as overvalued due to the impact of COVID 19 vaccines and treatments.

The Silver Lining

As per Biotech trend analysis, the Biotech sector is still seeing a significant cooldown; however, not all seems to be lost. Indeed, this calls for some major changes, but it looks like with a healthy dose of caution and wise use of existing funds, the Biotech sector can get back up on its feet.

Life Sciences is one area that still holds great potential, with Life Science VC firms holding reserves to help new companies spring before the public eye. The Biotech job market is still blooming with the past year’s expansion.

Finally, numerous Biotech firms that showed great potential for growth in the previous years are already living up to their promise in 2022. As per the NASDAQ Global Select, BioMarin Pharmaceutical, Alkermes, Exelixis, Ionis Pharmaceutical, and Vertex Pharmaceuticals have consistently shown an upward trend in the previous three to next six-month period.

Biotechnology Marketing Specifications

The uncertainty attached to this sector is one key factor that needs to be considered while marketing to it. The product can develop side effects that become apparent after the launch leading to the discontinuation of an entire line. There are also issues of obsolescence and estimation, which are visible after a Biotech industry analysis.

Marketing techniques can help influence a company’s stock market valuation in this highly volatile market. This does not mean that any small campaign can make an impact. A thoughtfully put-out marketing strategies that positively impacts the customer’s lifetime value can indeed make an impact.

This is not a short-term plan. The result might take some time to show but are pretty significant. For example, V. Kumar and Denish Shah did an in-depth Biotech industry analysis published under ‘Can Marketing Lift Stock Prices?‘. The two companies under the study saw an increase in their stock market valuation by 33% and 58%.

Additionally, you can increase CLV by using marketing techniques-

- Offer a personalized onboarding experience from your initial marketing campaign until you sign them as a lead. Offering your leads a customized experience based on their persona will persuade them to take action. You can even directly reach out to them through mailing lists .

- Offer valuable content. You can only make your leads stay by providing them value. They might lose interest if you start pushing a sale every time. Keep them hooked with informational content and subtly market your products.

- Increase customer support by helping out the customers who reach out to you. Offer them prompt omnichannel support so they don’t have to spend hours on it. Make use of technological advancements to help you achieve this.

Wrapping up

You must realize that no industry is entirely free from stock market volatility. The Biotechnology sector has seen some ups and downs, which will also affect it in the future. One can only stay prepared and employ methods that help decrease its impact. Carry out Biotech industry analysis to stay on top of trends.