- Date: Sep 15, 2021

- Category:

COVID-19 has not only resulted in human loss but also disrupted the economy. In fact, the significant impact of covid on the hospital industry is evident from its downward growth.

The US health sector makes up 18% of the country’s gross domestic product (GDP). Additionally, it has an annual revenue of about 4 trillion dollars – big enough to impact America’s entire financial system.

COVID-19 has shocked the sector by radically boosting the spending on healthcare. Besides, the American Hospital Association projects the pandemic’s financial impact on the industry will range between $53 to $122 billion in 2021.

This article highlights how the pandemic-generated recession impacts the hospital industry in more ways than ever projected before.

Health Sector Spending Curve Disrupted

The overall spending on the health sector has been notably consistent since 2014, falling between 4.3-5.6% annually. However, the emergence of the world pandemic has majorly disrupted this growth curve.

While the first two months of 2020 still showed steady growth of around 5.9%, the following months witnessed a rapid decline. Resultantly, health spending hit an all-time low of -20.1% in April 2020, as shown in Figure 1 below.

Table 1: National Health Spending and GDP (May 2019-May 2021 – July 2021 Spending Brief)

| May 2019 | May 2020 | April 2021 | May 2021 | |

| GDP | 21.34 | 19.42 | 22.65 | 22.74 |

| National Health Spending (HS) | 3.78 | 3.43 | 3.96 | 3.97 |

| HS Share of GDP | 17.7% | 17.7% | 17.5% | 17.5% |

| Growth from Prior 12 Months:- | ||||

| HS | 4.5% | -9.1% | 32.0% | 15.7% |

| GDP | 3.8% | -9.0% | 22.0% | 17.1% |

| HS minus GDP | 0.7% | -0.1% | 10.0% | -1.3% |

As shown in Table 1 and Figure 1, health spending has shown some recovery in 2021. It has grown at the year-on-year rate of 15.7% in May 2021 from May 2020.

However, we cannot ignore that while its pre-pandemic value was around 17.9-18% of GDP, health spending now stands at 17.5% of GDP.

Figure 1: Change in National Health Spending (HS) and GDP (2020-2021 – July 2021 Spending Brief)

A major reason behind this decline was curtailing of services to avoid infections. Besides, individuals opted to stay indoors and did not seek medical facilities to prevent risk exposure. This led to a significant decline in health spending in 2020.

Downward Demand of Professional Healthcare Services

While the spread of coronavirus has significantly increased the demand for special health services, it has collapsed the demand for routine health service providers. Resultantly, healthcare providers have observed radical financial losses over the past year, especially the rural and primary care providers.

The US hospital industry was projected to incur a financial loss of about $323.1 billion in 2020. Though the rate of loss has declined to $53-$122 billion in 2021, major damage has already been done. Moreover, the significant decline in inpatient volume by 19.5% in 2020 than in 2019 further reflects the deteriorating status of healthcare services.

Here are some of the primary reasons behind this decline.

- Risk of exposure to the virus

- Unavailability of space in the hospitals

- Absence of health insurance due to unemployment

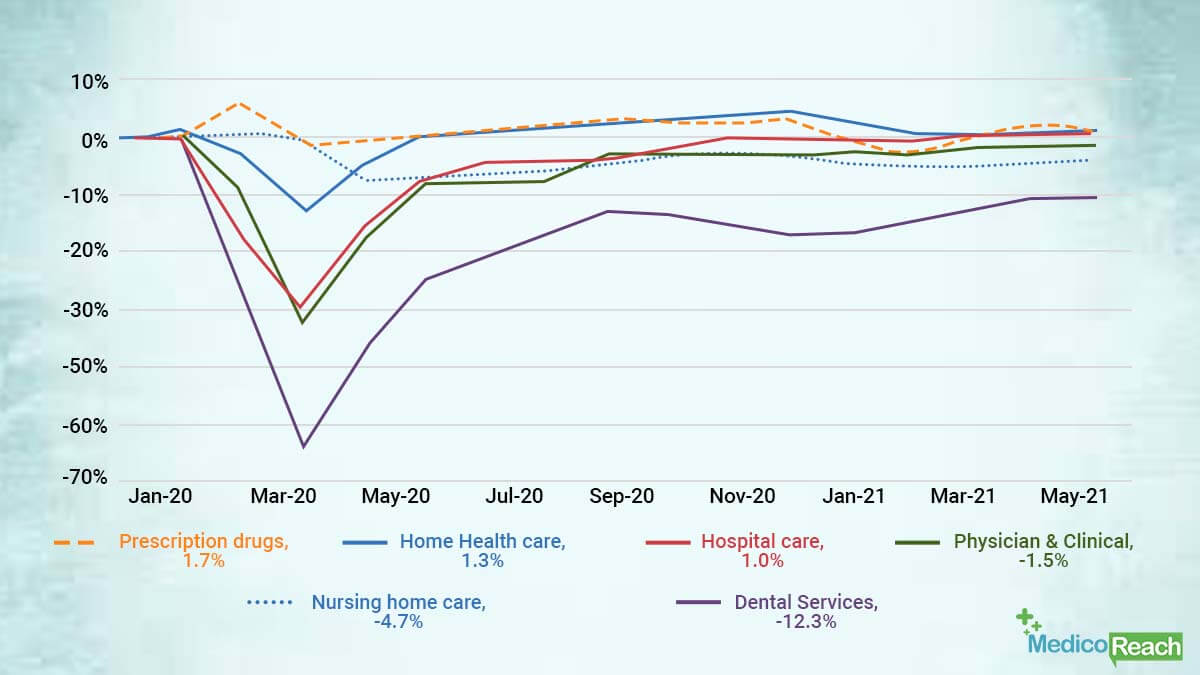

Besides, personal healthcare expenditures dropped by about 28% as compared to January 2020. While the dental services were hit the hardest (over -60%), hospital, physician & clinical services also saw a major drop (-38-39%).

Figure 2: Cumulative Change in National Health Spending by Major Categories (data labels show the % growth in May 2021 – July 2021 Spending Brief)

Despite the significant fall, every service seems to display an upward growth. However, the pace is relatively slow, especially for dental, nursing home care, and physician & clinical services – increasing at declining rates.

Rise in Hospital Prices

While healthcare spending and demand for routine medical services have decreased, COVID-19 has led to a major hike in hospital prices.

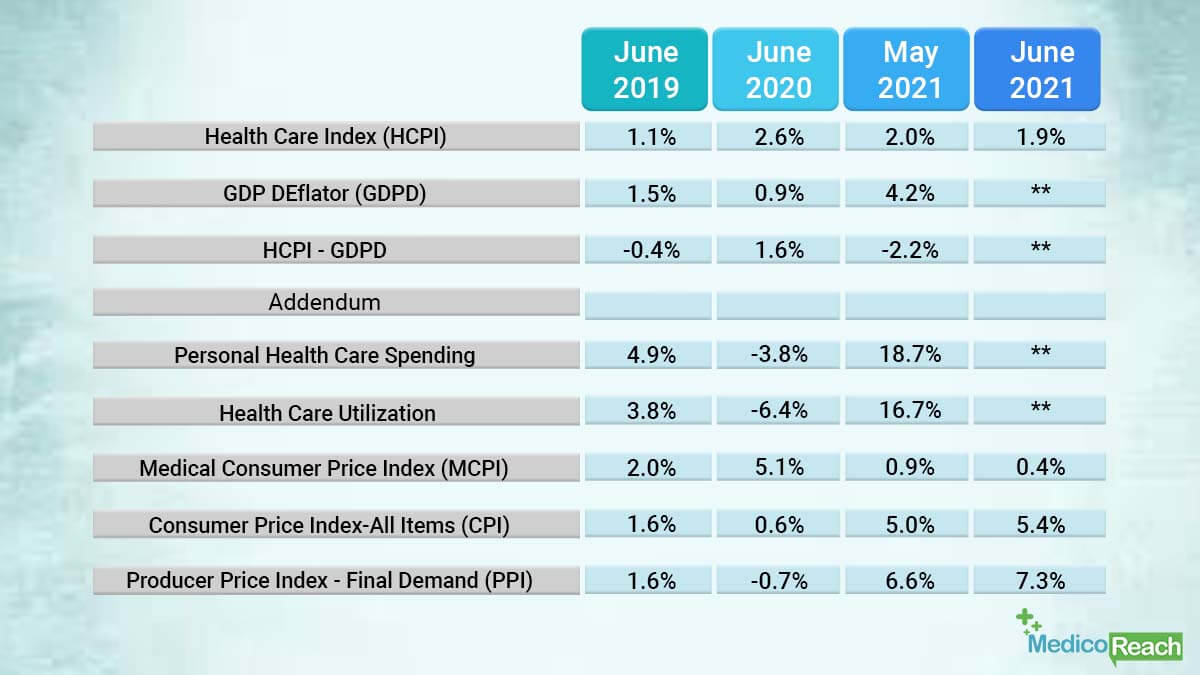

Hospital price growth had been increasing at a steady pace over the last years, but the emergence of the pandemic has accelerated the rate. While the Health Care Price Index was 1.1% in June 2019, it reached a whopping 2.6% in June 2020.

Table 2: Health Care Price Index (June 2019 – June 2021 – July 2021 Price Brief)

Impact on US Healthcare Facilities

Hospitals had to free up rooms, educate the staff members, pay overtime, and address inventory shortages.

COVID-19 impacted the healthcare facilities in varying degrees. Academic healthcare centers are among the most expensive medical systems in the US. Their existing financial vulnerability was further burdened due to the loss in cash flow and mounting debts.

Though veteran affairs medical centers did not incur high losses, they faced similar problems as their private counterparts. However, they also played a major role in contributing equipment and other medical supplies for the covid-affected American public.

Shift Towards Telehealth Services

While the quality of telehealth facilities is still anticipated, the dependence on this particular service has largely increased due to COVID-19.

The lack of investment in the infrastructure and education of this system kept its pace slow during the pre-covid era. However, the pandemic led to certain federal and state policies out-ruling the barriers and encouraging digital healthcare services, among other provisions.

Table 3: Federal and State Policy Provisions to Combat COVID-19 Emergencies (Health Affairs)

| POLICY THEME | KEY POLICY PROVISIONS |

| Regulatory | · Medicaid Section 1135 waivers granted · Expanded eligible providers, patients, services · Video requirement waived · Telehealth waiver for treatment applied to all diagnoses · Pre-existing, established relationship requirement waived · HIPAA-compliant platform requirement waived |

| Payment | · Reimbursement rendered similar to in-person services · Payment codes added for prolonged, audio-only evaluation · Hospitals enabled to bill as originating site |

| Benefit Design | · Cost-sharing waived or reduced for care furnished through telehealth |

The Projected Impact of COVID-19 On the US Health Sector

According to a survey by McKinsey, over 40% of individuals canceled their medical appointments due to COVID-19. As a result, this differed care can lead to a hike in the annual health costs of the country to about $30-65 billion.

While most services have been showing recovery, it is still at a declining rate. However, the adoption of telehealth services is likely to help the country deal with the disrupting health sector.

Nevertheless, the impact of covid on the hospital industry will remain for multiple years to come. Constant tracking of the changing patterns will help the relevant authorities devise the required strategies in the US health sector.