Grand View Research published a report recently that captured some interesting highlights about the orthopedic medical device industry. The article puts the global market size for the sector at $40.9 billion in 2021, with a compounded annual growth rate (CAGR) of 3.1% from 2022 to 2030.

According to another study, musculoskeletal conditions, currently affecting 1.71 billion people, will drive the market revenue even higher. Still, that’s just an estimation. What really matters are the orthopedic medical device trends that are already shaping the healthcare industry.

Want to find out what they are? Let’s dive right in!

Four Prominent Trends In The Orthopedic Medical Device Industry

Advancements in medical technology will always be a favorite topic of discussion when analyzing the healthcare sector. The orthopedic industry is no different. However, some specific trends demand a closer look. So, here they are:

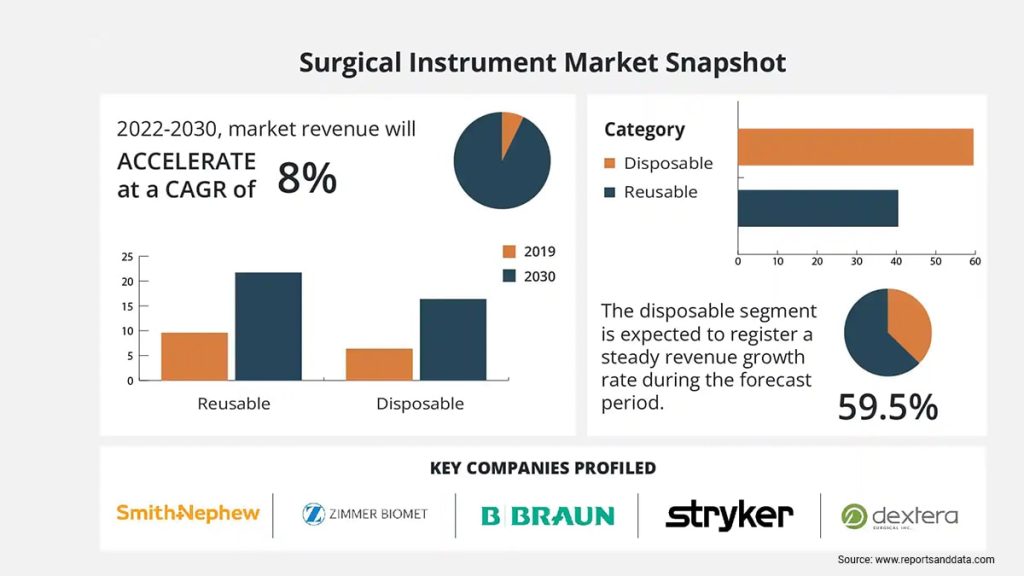

1. Introducing Disposable Orthopedic Surgical Instrumentation

Since the inception of the clinical specialization, the orthopedic industry has relied on reusable surgical instrumentation. This includes the use of medical drills, saws and screwdrivers. Now, however, the sector has been gradually shifting towards disposable tools, especially in ambulatory surgical settings. These come in sterile pre-packaged boxes and are used for a single procedure before being sent back to a central manufacturing or recycling plant. If feasible, the device material is repurposed in the production process of new orthopedic equipment.

While there are several reasons for this transition, the three primary ones include:

- Increased infection risk due to cross-contaminated reused orthopedic surgical equipment

- The higher cost and prolonged reprocessing lifecycle of non-disposable instrumentation

- Imposed sterilization guidelines from the Centers for Disease Control and Prevention (CDC)

Now, the demand for such equipment is on track to grow exponentially. For instance, experts estimate that the global disposable spinal instruments market will grow at a CAGR of 8.3%, reaching a valuation of $96.5 million by 2028.

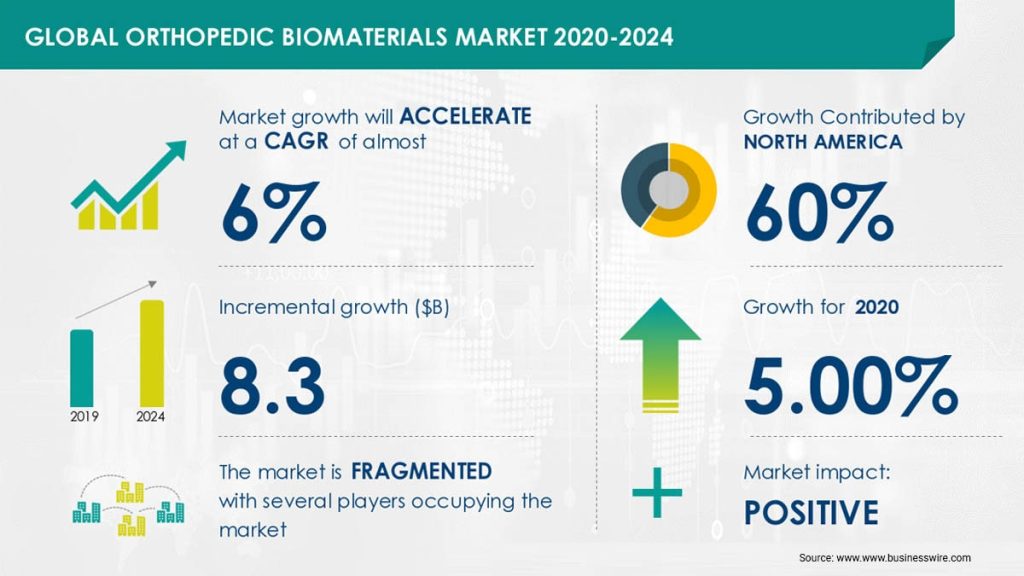

2. Development Of New Biotech Coating In Orthopedic Medical Devices

One of the most exciting orthopedic medical device trends is the development of new bioactive coatings and composites for bone implants.

Currently, the common practice is to manufacture such reconstructive equipment with titanium and other related alloys. However, this can lead to several issues, such as:

- Implantation resistance due to reactionary metabolism

- Allergic reactions to the nickel component found in stainless steel composites

- Widespread bone destruction due to immunological responses to cobalt particles

Another such development is an examination of bio-degradable magnesium alloys to reduce the risks associated with titanium composites.

While all of this is still in its early stages, this has significant implications for the broader B2B healthcare sector. In short, if advertisers manage to penetrate the market at the very beginning, they could be looking at exponential growth

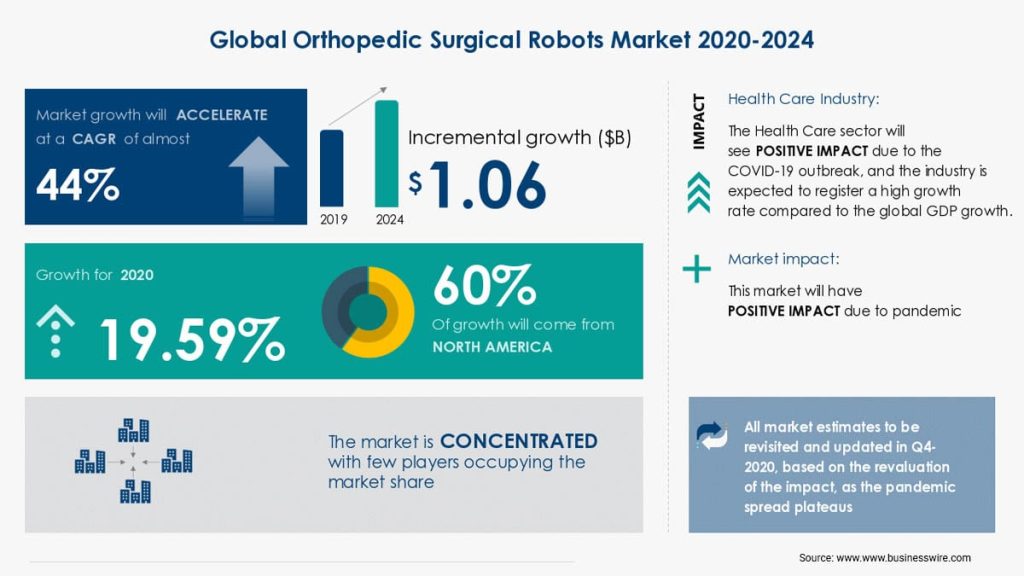

3. The Growing Use Of Robots In Orthopedic Surgical

The use of robots in general surgery was still in its infancy a few years back. However, current orthopedic medical device trends all point towards the increasing use of such systems. In fact, the market size for orthopedic surgical robots will reach roughly $24.2 billion by 2029.

This projected growth is mainly due to the range of benefits that come with such tools, including:

- Greater precision and accuracy in bone surface preparation

- Improved spatial accuracy and more reliably reproducible surgical outcomes

- Seamless isolation, rigid fixation and the secure placement of devices in the known bone positions

Now, the current usage of robotic orthopedic surgery is still restricted to knee and hip replacements. However, there is ongoing development for a tunnel drilling system to aid in ligament reconstruction alongside trauma and spinal operations.

There is a caveat here, though. There is a distinct lack of real-time data and research in this area. From procedure efficacy and cost to safety and training, there are still several challenges to overcome before robot-assisted surgery becomes standard practice. Yet, the rapidly growing market size of joint surgeries could be enough to make a case for the increased adoption of such equipment.

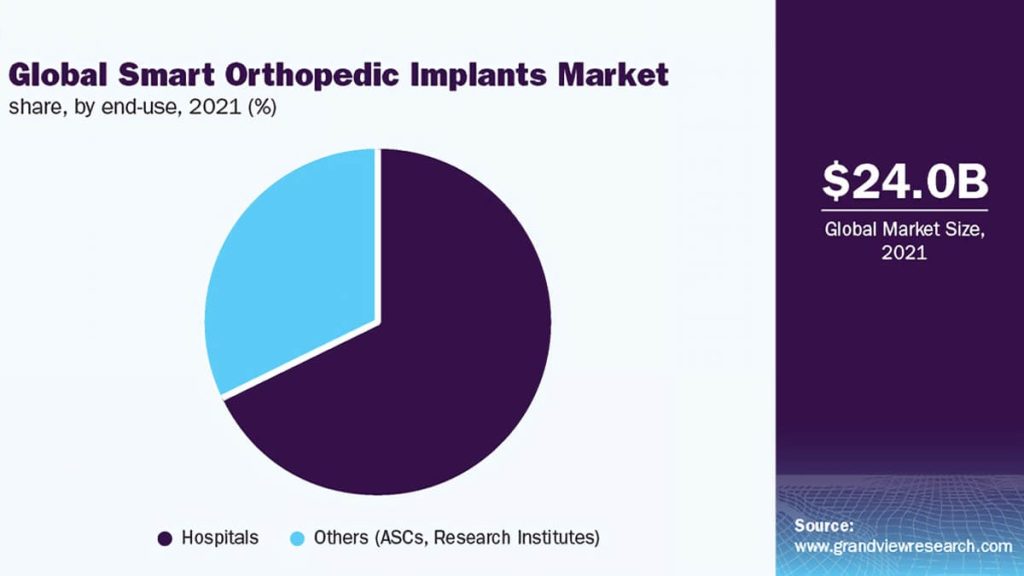

4. Development Of Smart Implants And Augmented Reality (AR) In Orthopedic Technology

One of the most prominent orthopedic medical device trends is the growing use of advanced healthcare technology in the sector.

Quite recently, the Food and Drug Administration (FDA) marked a historical moment when it approved Patient Specific Talus Spacer 3D-printed implants in 2021. The device replaces a connecting bone in the ankle joint and can be customized according to patient preference.

This focus on advanced implants also extends to smart technology. For example, microprocessors embedded during reconstructive orthopedic surgeries are helping doctors gather real-time data on how well patients fare in the post-operative phase. Orthopedic and spine device companies like Zimmer Biomet and Canary Medical corporations driving this market even further.

Healthcare executives are also looking into AR spinal surgical systems. The technology creates a computer-generated 3D image of the spine, enabling doctors to visualize the structural issues in the area without conducting invasive orthopedic operations. The US-based Enovis is leading this new development. Its acquisition of Insight Medical Systems for its AR spinal guidance tool is meant to serve as a benchmark for overhauling current reconstruction surgical practices.

Looking Towards A Brighter Future

The mentioned orthopedic medical device trends in this article all lean towards establishing one objective truth: The healthcare industry is growing exponentially. Hence, there are obstacles like restrictive, albeit necessary, government regulations. The potential increase in industry competition could also spell trouble for some. However, despite all the challenges, a specific group benefits from these emerging trends are B2B healthcare marketers. And if advertisers consider these developments to inform their promotional strategies, the results could be tremendously beneficial.