- Date: Sep 15, 2021

- Category:

- 1. Medtronic

- 2. Johnson & Johnson

- 3. Abbott Laboratories

- 4. Philips Healthcare

- 5. GE Healthcare

- 6. BD

- 7. Siemens Healthineers

- 8. Cardinal Health

- 9. Stryker Corporation

- 10. Baxter International Inc

- 11. Boston Scientific

- 12. B. Braun

- 13. 3M Health Care

- 14. EssilorLuxottica

- 15. Danaher Corporation

- In Conclusion

Driven by technological advancements and expanding the scope of clinical utilization, the demand for diagnostic imaging devices is escalating by the day.

Other primary reasons include the demand for early diagnosis of chronic diseases like tumors and cancers and higher investments.

As a result, the diagnostic imaging market will likely hit $35 billion in 2026 globally. This growth at a 5.7% CAGR from 2021-2026 is further driven by the increasing senior population.

This article will walk you through the top 15 diagnostic imaging device manufacturers, along with insights into their key points and market share. Before going ahead, checkout this radiologist email list to access the correct contacts of the top radiologists to sell your radiology products and services .

1. Medtronic

Key Company Metrics

- Revenue: $30.12 bn

- Percentage Change: +4%

- Prior Fiscal: $28.93 bn

- Employees: 90,000

- Global Headquarters: Dublin, Ireland

Medtronic bags the top position in the list with the highest revenue of $30.12 billion in the fiscal year 2020-2021. According to Geoffrey S. Martha, Chairman and CEO, its last quarter witnessed most of its markets running at almost pre-COVID growth rates.

2. Johnson & Johnson

Key Company Metrics

- Revenue (2021 Q2): $23.3 bn

- Percentage Change: -11.6%

- Revenue (2020 Q2): $18.3 bn

- Employees: 135,000

- Global Headquarters: New Brunswick, New Jersey

Johnsons & Johnson has reported global medical devices sales of about $7 billion in 2021. These include equipment for orthopedics, surgery, vision, and Interventional Solutions.

Johnsons & Johnsons Medical Device Sales in Second Quarter 2021 (Johnsons & Johnsons)

3. Abbott Laboratories

Key Company Metrics

- Revenue: $22.59 bn

- Percentage Change: +13.2%

- Prior Fiscal: $19.95 bn

- Employees: 109,000

- Global Headquarters: Chicago, Illinois

Abbott Laboratories is a US-based healthcare company specializing in medical devices, diagnostics, pharmaceuticals, and nutrition. In 2020, the company’s revenue from diagnostics was about $10,805 million and $11,787 million from medical devices.

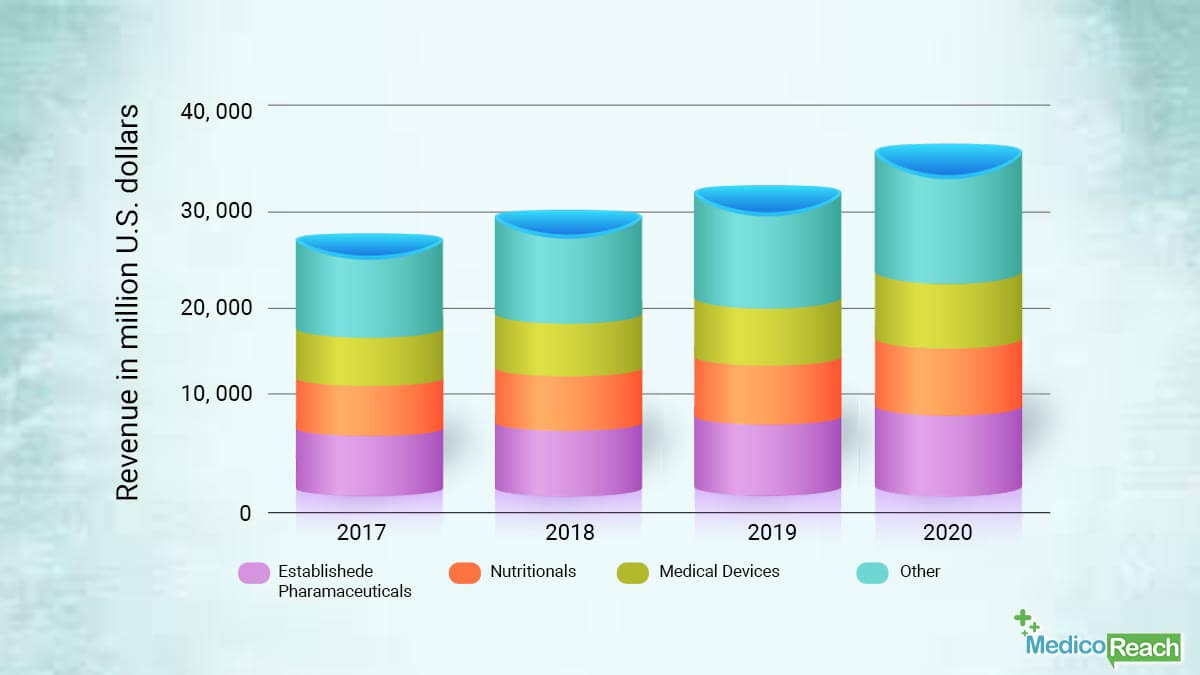

Abbott Laboratories’ segment revenues from 2017-2020 (in million US dollars – Statista)

4. Philips Healthcare

Key Company Metrics

- Revenue: $19.32 bn

- Percentage Change: +13.%

- Prior Fiscal: $17.10 bn

- Employees: 81,592

- Global Headquarters: Amsterdam, Netherlands

Philips excels in end-to-end imaging solutions, connecting data and technology for higher productivity. The technologies include radiation oncology, computed tomography, diagnostic X-ray, magnetic resonance, refurbished systems, molecular imaging, interventional radiology, and ultrasound.

5. GE Healthcare

Key Company Metrics

- Revenue: $18.01 bn

- Percentage Change: -10%

- Prior Fiscal: $19.9 bn

- of Employees: 50,000

- Global Headquarters: Chicago, Illinois

GE Healthcare is a unit of the US-based GE Electric Company. It specializes in healthcare systems designed for imaging, ventilator, ultrasound, diagnostic ECG, and patient monitoring, among others. The company introduces the latest technologies such as the recent AI solutions for MSK, body, and cardio imaging.

6. BD

Key Company Metrics

- Revenue: $17.11 bn

- Percentage Change: -1%

- Prior Fiscal: $17.29 bn

- Employees: 72,000

- Global Headquarters: Franklin Lakes, New Jersey

BD diagnostics is a pioneering diagnostic imaging device manufacturer. It offers blood culture systems, clinical research reagents products, identification and susceptibility systems, clinical microbiology, and mycobacteria testing systems.

7. Siemens Healthineers

Key Company Metrics

- Revenue: $16.93 bn

- Percentage Change: -0.01%

- Prior Fiscal: $16.99 bn

- Employees: 54,300

- Global Headquarters: Erlangen, Germany

Siemens Healthineers provides over 15 diagnostic imaging devices and systems. These include angiography, mammography, ultrasound, robotic X-ray, and more. The company strives for continuous innovation, such as its molecular Fast Track Diagnostics (FTD) SARS-CoV-2 Assay test kit.

8. Cardinal Health

Key Company Metrics

- Revenue: $15.44 bn

- Percentage Change: -1.2%

- Prior Fiscal: $15.63 bn

- Employees: 48,000

- Global Headquarters: Dublin, Ohio

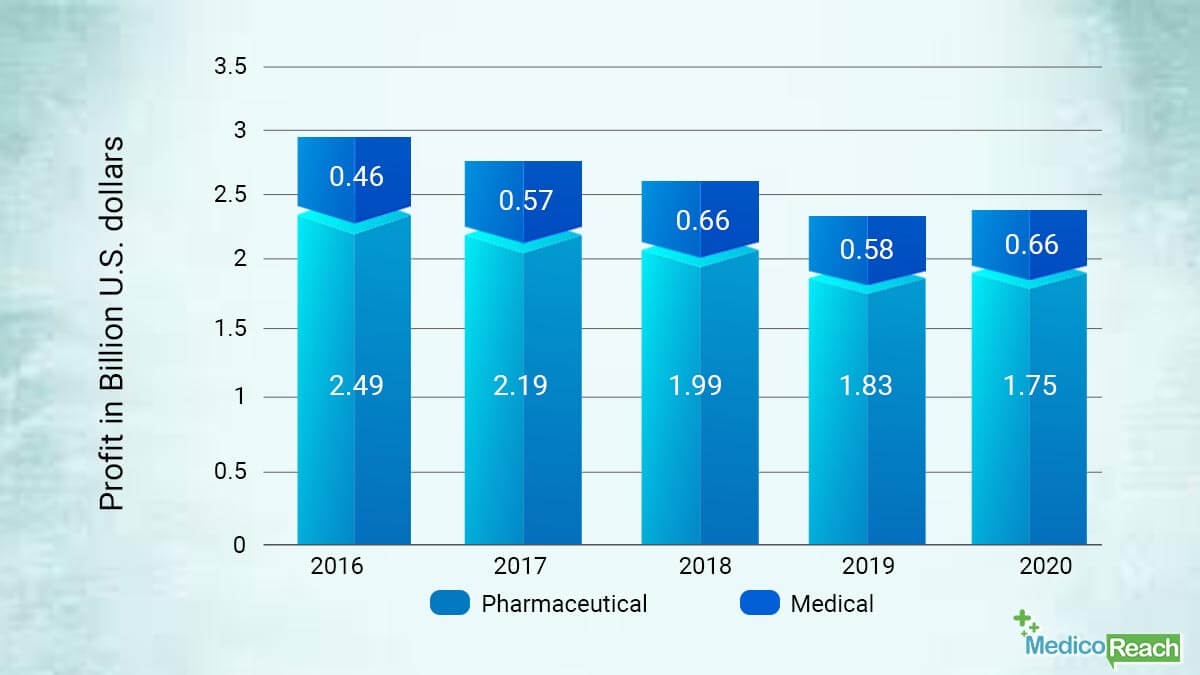

Cardinal Health Annual Profit by Segment (2016-2020 Statista)

Cardinal Health is a US-based company offering healthcare services and products in the medical and pharmaceutical divisions. The company serves a whopping 90% of the hospitals in the US. Moreover, the company acquired Medtronic’s patient care portfolio for about $6.1 billion in 2017, further increasing the overall revenue of this 14th highest revenue-generating company in the US.

9. Stryker Corporation

Key Company Metrics

- Revenue: $14.35 bn

- Percentage Change: -3.6%

- Prior Fiscal: $14.88 bn

- Employees: 40,000

- Global Headquarters: Kalamazoo, Michigan

The Stryker Corporation has three primary business segments – orthopedics, neurotechnology and spine, and medical and surgical (MedSurg). The company has acquired multiple businesses, including OrthoSensor Inc. and TMJ Concepts being the most recent ones – in 2021.

10. Baxter International Inc

Key Company Metrics

- Revenue: $11.67 bn

- Percentage Change: +3%

- Prior Fiscal: $11.40 bn

- of Employees: 40,000

- Global Headquarters: Deerfield, Illinois

Baxter International Inc. has two businesses in its name – BioScience and Medical Products. The latter stream specializes in products for oncology, BioSurgery, and Critical Care, among others. The company acquired Seprafilm for about $350 million in 2019.

11. Boston Scientific

Key Company Metrics

- Revenue: $9.91 bn

- Percentage Change: – 7.6%

- Prior Fiscal: $10.73 bn

- Employees: 38,000

- Global Headquarters: Marlborough, Massachusetts

Boston Scientific specializes in producing medical devices used in oncology, radiology, cardiology, and urology, among others. The company has announced the acquisition of three major companies in 2021 – Preventice Solutions Inc., Lumenis Ltd, and the 73% of Farapulse it did not own.

12. B. Braun

Key Company Metrics

- Revenue: $9.12 bn

- Percentage Change: +8.7%

- Prior Fiscal: $8.39 bn

- Employees: 64,000

- Global Headquarters: Melsungen, Germany

The Braun family-owned medical and pharmaceutical company has been running for over two centuries now. It has subsidiaries in over 60 countries and was also recognized as the best German company to work for in 2009.

13. 3M Health Care

Key Company Metrics

- Revenue: $8.34 bn

- Percentage Change: +12.3%

- Prior Fiscal: $7.43 bn

- Employees: 94,987

- Global Headquarters: Saint Paul, Minnesota

3M healthcare is one of the four business groups of 3M. It strives to deliver innovative products in the industry, such as the radiology reporting software introduced along with Rad AI in 2020. It will help produce custom radiology reports to streamline workflow for radiologists.

14. EssilorLuxottica

Key Company Metrics

- Revenue: $8.25 bn

- Percentage Change: +6.7%

- Prior Fiscal: $8.84 bn

- Employees: 140,000

- Global Headquarters:

EssilorLuxotica is a French-Italian company founded in 2018, with the merger of Luxottica (Italian) and Essilor (French). Though the company primarily focuses on designing and manufacturing eyewear, it also produces equipment for diagnostic and imaging, refraction, edging, and mounting.

15. Danaher Corporation

Key Company Metrics

- Revenue: $7.40 bn

- Percentage Change: +12.8%

- Prior Fiscal: $6.56 bn

- Employees: 71,000

- Global Headquarters: Washington, D.C

Danahar Corporation primarily focuses on manufacturing life sciences, environmental & applied solutions, and diagnostics devices. Over the years, the company has acquired Beckman Coulter, Radiometer, Leica Biosystems, and Cepheid in its diagnostics unit.

In Conclusion

The diagnostic imaging devices market is divided into equipment for X-ray, CT scan, ultrasound, magnetic resonance, cardiovascular monitoring, and nuclear imaging, among others.

With the emergence of novel viruses and health conditions, the market is at its peak competitive level. Compared at the global level, the US diagnostic imaging devices market will generate the highest revenue of $11,131 million in 2021.

Besides the competition, the need for portable and smart devices is now more than ever. The top diagnostic imaging device manufacturers constantly innovate and provide technologically advanced products to meet the growing healthcare demands.